Lifetime Care and Support Fund

1. Organisational Overview

The Lifetime Care and Support Scheme (LTCSS) was established under the Lifetime Care and Support (Catastrophic Injuries) Act 2014 (LTCS Act) and commenced operation on 1 July 2014. The LTCSS provides reasonable and necessary on-going treatment and care to people who have been catastrophically injured as a result of a motor accident in the Australian Capital Territory, on or after 1 July 2014.

The scheme covers pedestrians, cyclists, motor bikes and motor vehicles so long as there is at least one registrable vehicle involved in the motor accident, regardless of where fault is attributable for the accident. As a result, it extends motor vehicle accident coverage for catastrophic injuries beyond what was previously available under Compulsory-Third Party (CTP) Insurance to include those persons who may be considered to be at-fault, or someone who is involved in a single vehicle accident, or even a blameless accident.

The LTCSS is a companion scheme to the National Disability Insurance Scheme in the ACT, and is transforming the way the ACT community supports people with a disability, their families and carers.

As it is a no-fault scheme, the LTCSS reduces the stress on those injured and their families that has previously been associated with litigating claims to meet ongoing treatment costs. It ensures early access to medical and rehabilitation care. Further, as treatment and care is on-going, those injured no longer have to worry whether a lump sum payment will meet their needs for the rest of their life and whether they will receive the ongoing treatment and care they need.

Examples of treatment and care provided to participants in the Scheme include:

- medical treatment;

- rehabilitation;

- attendant care services; and

- home and transport modification.

The LTCSS is funded by a levy on compulsory third-party insurance policies. The financial operations of the LTCSS are reflected in the LTCS Fund which is a separate financial reporting entity.

The LTCS Act is administered by the Chief Minister, Treasury and Economic Development Directorate (CMTEDD). Under section 10 of the LTCS Act, the Minister must appoint a public servant as the LTCS Commissioner of the Australian Capital Territory (ACT). Ms Karen Doran, Executive Director of the Economic and Financial Group, CMTEDD was appointed by the Minister as the LTCS Commissioner commencing 1 July 2014.

The functions of the LTCS Commissioner are supported by the Financial Framework Management and Insurance Branch of the Economic and Financial Group, within CMTEDD.

1.1. LTCS Commissioner Responsibilities

Under the provisions of the LTCS Act, some of the key responsibilities of the LTCS Commissioner are to:

- determine the LTCS levy amount;

- issue and monitor guidelines for the LTCSS;

- assess applications for eligibility for Scheme participation;

- assess reasonable and necessary treatment and care needs of participants; and

- pay assessed treatment and care needs.

1.2. Highlights

As 2015-16 was the second year of operation of the LTCSS, the key priorities during the financial year were to:

- administer the LTCSS in accordance with the requirements of the LTCS Act and Guidelines;

- continue to improve procedures for the efficient and effective delivery of the LTCSS, including implementation of the Intergovernmental Agreement (IGA) signed by the ACT Government in February 2015 with NSW, that enabled the NSW Lifetime Care and Support Authority (LTCSA) to provide co-ordinated lifetime care and support services on behalf of the LTCS Commissioner to participants in the ACT; and

- monitor how the Scheme is operating including whether it is meeting participant expectations.

Against these priorities, the LTCS Commissioner:

- signed the Care and Support Agreement with the LTCSA providing the legal framework for the delivery of coordinated care and support services to participants in the LTCSS by LTCSA on the LTCS Commissioner’s behalf;

- transferred the management of ACT participants’ co-ordinated lifetime care and support services to LTCSA commencing from 1 September 2015;

- commenced six-monthly meetings of the LTCS working group with our administration partners, the LTCSA, as part of the governance arrangements to monitor service delivery following the commencement of service delivery by LTCSA on 1 September 2015;

- commissioned and received the first LTCS participant feedback report on the administration and effectiveness of the Scheme services provided to participants, including recommendations on ways service delivery may be enhanced;

- determined, having regard to independent actuarial advice, the LTCS levy for motor vehicles for 2016-17;

- approved guidelines to give effect to the extension of the LTCS Scheme to cover private sector work injuries; and determined, having regard to independent actuarial advice, the new LTCS levy for 2016-17 on private sector workers compensation insurers and self insurers to fund the extension of the Scheme; and

- re-designed the LTCSS website apps.treasury.act.gov.au/ltcss and responded to queries from the public received by way of telephone calls through Canberra Connect, via the LTCSS general inquiries email address ltcss@act.gov.au; and via general written correspondence.

LTCS Scheme for work injuries

In 2015-16, the ACT Government introduced and passed legislation to implement a National Injury Insurance Scheme (NIIS) for private sector work place accidents in the ACT as part of its commitment to the national disability reforms recommended by the Productivity Commission.

The legislation implements the NIIS for workers by extending the existing LTCSS. The extension of the Scheme, which commenced on 1 July 2016, covers catastrophic work injuries occurring on or after 1 July 2016.

The extension to cover injured workers is being fully funded through a levy collected from private sector workers compensation insurers and self-insurers.

Enhancements to the LTCS Scheme

During 2015-16, amendments to provide two technical improvements to the LTCSS were introduced and passed in June 2015. First, these amendments address an anomaly in coverage of the LTCSS that arose in drafting the LTCS Act that might have resulted in some people involved in accidents with ACT Government-owned vehicles not being covered by the LTCSS. The amendment corrected this gap by including ACT Government-owned vehicles without CTP insurance policies in the eligibility criteria for the LTCSS.

Secondly, the amendments sought to address some inefficiencies relating to the delivery of LTCSS benefits to overseas participants.

Based on the experience of the Scheme to date and other similar schemes, delivery of lifetime care to participants residing overseas is often complicated and inefficient. To address this, amendments were passed to streamline delivery of benefits to scheme participants living overseas either permanently or for extended periods, through flexible payment arrangements. These include the ability to offer; first a lump sum payout to foreign national scheme participants in lieu of receiving future LTCSS benefits; and secondly, periodic payments to cover a participant’s approved care needs while the person is living abroad.

These arrangements are intended to afford participants the opportunity to put in place more advantageous arrangements for their treatment and care calibrated to their country of residence’s medical infrastructure, to help facilitate better health outcomes for participants living overseas.

1.3. Our Participants

Any person who is catastrophically injured in a motor vehicle accident in ACT can apply to become a participant in the LTCSS, regardless of their role in the motor accident. An ACT private sector worker catastrophically injured at work on or after 1 July 2016 can now also apply.

An applicant must however meet certain injury criteria to be eligible (more information can be found at apps.treasury.act.gov.au/ltcss).

The LTCS Commissioner received no new applications in the 2015-16 financial year for participation in the Scheme. As at 30 June 2016 there are five participants who have been accepted into the LTCSS (there were also five participants at 30 June 2015) and are receiving co-ordinated treatment and care benefits through the Scheme. Of the five participants, four are interim participants and one participant has now been accepted as a lifetime participant into the LTCSS.

Applying to the Scheme

All participants commence as ‘interim participants’ for up to two years. During this time, the Scheme will pay for any reasonable and necessary treatment, rehabilitation and care related to the motor accident injury.

After two years, an interim participant may be eligible to become a ‘lifetime participant’. Children do not apply for lifetime eligibility until they are at least five years old.

It is within the predicted range of claims per year to have no new participants accepted into the Scheme during a financial year.

Our participant profile

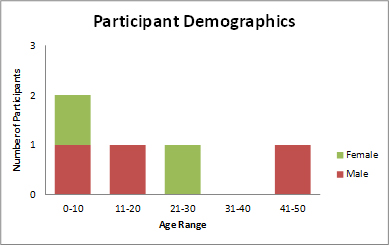

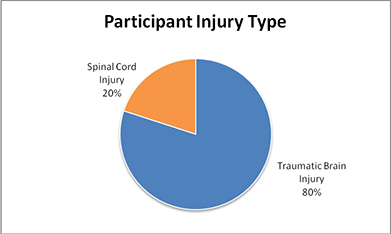

The LTCSS has quite a young age demographic with the average participant age at the time of injury just less than eighteen years of age. Of the five participants in the Scheme, two were under ten years of age when their accident occurred.

The Scheme covers five types of catastrophic injuries – traumatic brain injury, spinal cord injury, amputations, burns and vision loss. Four participants (80 per cent) have suffered a traumatic brain injury.

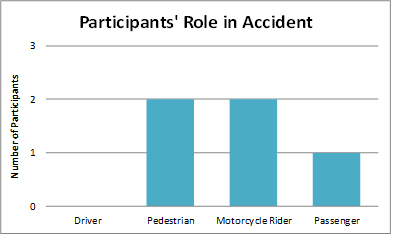

Our Scheme participants under ten years of age were a passenger and a pedestrian in the accidents that caused their injuries. Of the two drivers injured, both were motorcycle riders.

Provided Treatment, Rehabilitation and Care

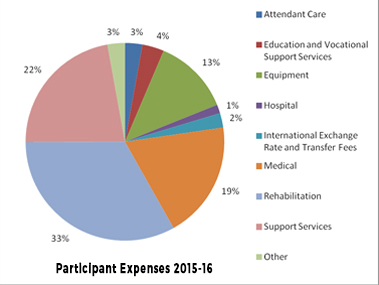

In 2015-16, the LTCS Commissioner spent a total of $423,000 on services for participants. As expected, given there were no new participants in the year, the majority of expenses for the existing participants related to rehabilitation and medical type services. The largest expenditure category was rehabilitation services (33 per cent). The second largest expenditure type was support services at 22 per cent which comprise mainly case management fees and travel expenses for participants and service providers to access/provide treatment. Medical was the third largest expense category.

In comparison, in 2014-15, the LTCS Commissioner spent a total of $353,000 on services for participants, with the majority of expenses related to hospital and support services expenses due to all participants being within one year of their injury date.

Accessing Services – How the scheme works with participants

The LTCS Scheme provides reasonable and necessary treatment, rehabilitation and care as it is required throughout the person’s life and assists them to plan their rehabilitation and care services.

Participants are supported as needed by a LTCSS coordinator. The coordinator arranges for a case manager to help plan services required by the participant.

The case manager will work with the participant and their service providers to request approval for services. Services are organised as required and the participant and their families are closely involved in each of these requests. Usually payment of approved treatment and care needs is made by the LTCSS directly to the supplier of the services.

Accessing Services – Participants’ perception of the Scheme

“Participants felt very positive about the Scheme’s existence ... especially for the financial costs of treatment, rehabilitation and care being met”[vii]

‘Thinking back to the beginning for me it was support services and people that knew where to go and what to do....just to have level heads around us organising services was such a relief.’

‘It’s been a great support....It’s been a great help, finding the services. We really haven’t had to think about anything….With the accident and injuries being so severe we’ve had a lot of other things to do so it’s been great to have that side of it done – it has relieved a lot of stress.’

Participant Expenses 2015-16

1.4. Outlook

Strategic priorities in 2016-17 for the LTCSS include:

- completing the implementation of the extension of the LTCSS to catastrophically injured private sector workers;

- developing/amending the necessary guidelines and procedures to implement the LTCS Act amendments to streamline delivery of benefits to scheme participants living overseas;

- continuing to improve guidelines and procedures for the efficient and effective delivery of the LTCSS;

- continuing to collect feedback from participants on their expectations and experience with the LTCSS; and

- undertaking investments in accordance with the Fund’s investment strategy.

2. Performance Analysis

The LTCSS’ 2015-16 performance indicators are included in the Budget Portfolio Statements for the LTCS Fund, and are reported as part of the LTCS Fund’s Statement of Performance.

The LTCS Fund achieved all its accountability targets in 2015-16.

Explanation of Performance Indicators

a. Independent actuarial review to advise on the required fund contribution

The LTCS levies are crucial to the funding of the Scheme, with a levy applying to all CTP policies payable at the time of vehicle registration and from 1 July 2016, a levy will apply to private sector workers compensation insurers. As required by the LTCS Act, the levies are set by the LTCS Commissioner based on independent actuarial advice. The level at which the levies are set in any given year is intended to secure sufficient funds to meet the costs of all estimated present and future liabilities of new participants of the LTCSS in that year. The LTCS Levies are for a financial year and are set in May/June before the commencement of a financial year on 1 July.

In accordance with section 83 of the LTCS Act, the LTCS Commissioner obtained before the beginning of the contribution period, a report from an independent actuary in relation to the amounts needed to be contributed to the LTCS fund for the contribution period.

Two actuarial reports for the 2016-17 contribution period were undertaken by Cumpston Sarjeant Pty Ltd for the purposes of setting the 2016-17 LTCS Levies for motor vehicle injuries and work injuries and final reports were received in March 2016.

b. Determine LTCS Levy

The LTCS Commissioner has determined that the 2015-16 LTCS levy of $34 for a twelve-month CTP policy will be increased to $35 in 2016-17, for all vehicles except those that are subject to distance restrictions applicable as part of the ACT’s Concessional Vintage Vehicle Registration (CVVR) Scheme. A LTCS Levy of $7 for a twelve-month CTP policy has been determined for the CVVR Scheme. The Levy determination for the 2016-17 contribution period was notified on the Legislation Register on 2 May 2016 for motor vehicles.

The levy amounts for the private sector workers compensation insurers and self-insurers[viii] was notified on 30 June 2016.

The LTCS Commissioner has determined these LTCS levies based on the best available data. Further, as the Scheme is only in its second year of operation for motor vehicle accidents and has just commenced for work accidents, a high degree of uncertainty still remains with respect to the number of participants and the costs of providing services. By the very nature of the injury type covered by the Scheme, the experience can be expected to be volatile from year to year. Noting that it may take several years of experience before more robust scheme data becomes available the LTCS Commissioner will reassess the levy amounts, on the basis of updated advice of an independent actuary, after the scheme has operated for another 12 month period.

c. Develop long-term investment strategy

In accordance with section 80 of the LTCS Act, an amount in the LTCS fund banking account that is not needed for the purposes of payments to be made by the LTCS Commissioner under part 6 of the LTCS Act, may be invested. This performance indicator was to establish a strategic asset allocation, a target investment return and investment options for surplus LTCS funds.

The Investment Plan, that implements the commitment to establish a long-term investment strategy during 2015-16 for the LTCS Fund, was approved by the LTCS Commissioner on 28 April 2016.

d. Develop client experience and engagement feedback mechanism

The functions of the LTCS Commissioner under the LTCS Act include advising the Minister about the administration, efficiency and effectiveness of the LTCSS; and monitoring the provision of care, treatment, rehabilitation, long-term support and other services to participants in the LTCSS.

The aim of developing a client experience and engagement feedback mechanism is to be able to inform the LTCS Commissioner on the administration and effectiveness of the Scheme services provided to participants.

A survey of the LTCSS participants was conducted by Modd Research and Evaluation Pty Ltd in March 2016 with a final report received in June 2016. The purpose of the research was to gain feedback from the participants and/or their nominated persons (respondents) in order to understand participant expectations of and experience with the LTCSS.

Research Findings and Recommendations

Overall the research reported that all respondents felt very positive about the Scheme’s existence and expressed a great deal of gratitude especially for having the financial costs of treatment, rehabilitation and care met. Respondents felt the Scheme is meeting the needs of participants to a large extent and one participant indicated their needs were met ‘one hundred per cent’. While all respondents expressed gratitude for what the LTCSS provides, some did not feel confident that they knew they were accessing all that they were eligible for. Some respondents understood that some needs may not be within the scope of the Scheme’s terms of reference. For others, there was a perception that there was a lack of clarity as to what the Scheme covered or did not cover.

The report included some recommendations to further enhance service delivery and participant experience in the Scheme, such as the provision of information about the Scheme’s benefits at regular 3 or 6 month intervals to refresh and reinforce participant understanding of what services the Scheme provides.

As the majority of the findings relate to the management of service delivery to participants by the LTCSA, a copy of the research report and findings has been provided to the LTCSA and the findings discussed with them. It is expected that the client experience and engagement feedback will be conducted on an annual basis.

3. Scrutiny

During the reporting period the LTCSS did not participate in any Legislative Assembly Committee inquiries related to its activities. There were no Audit Office performance audit reports with recommendations in respect of the LTCSS, and no Ombudsman Reports.

4. Risk Management

The LTCSS is part of CMTEDD. As such, it is covered in CMTEDD’s risk management arrangements.

5. Internal Audit

The LTCSS is part of the CMTEDD Audit and Risk Committee. CMTEDD’s Annual Report section on the Internal Audit Committee applies to the LTCSS.

No internal audits of the LTCSS were undertaken during 2015-16.

6. Fraud Prevention

The LTCSS is part of CMTEDD. As such, it is covered in CMTEDD’s Fraud and Corruption Prevention Plan.

7. Workplace Health and Safety

The LTCSS is part of CMTEDD. CMTEDD’s Annual Report section on Workplace Health and Safety practices applies to the LTCSS.

8. Human Resource Management

The LTCSS is part of CMTEDD. CMTEDD’s Annual Report section on HR management applies to the LTCSS.

9. Ecologically Sustainable Development

The CMTEDD’s Annual Report section on Ecologically Sustainable Development applies to the LTCSS.

For further information contact:

Karen Doran

LTCS Commissioner

+ 61 2 6207 0264

Karen.Doran@act.gov.au